The ‘Pipelineistan’ conspiracy: The war in Syria has never been about gas – Paul Cochrane

The pipeline hypotheses do not stand up to the realities of how energy is transported through the Middle East in the 21st century

Six years into a conflict that has killed at least 400,000 people, there is a widely held belief that the bloodshed in Syria is simply another war over Middle Eastern energy resources.

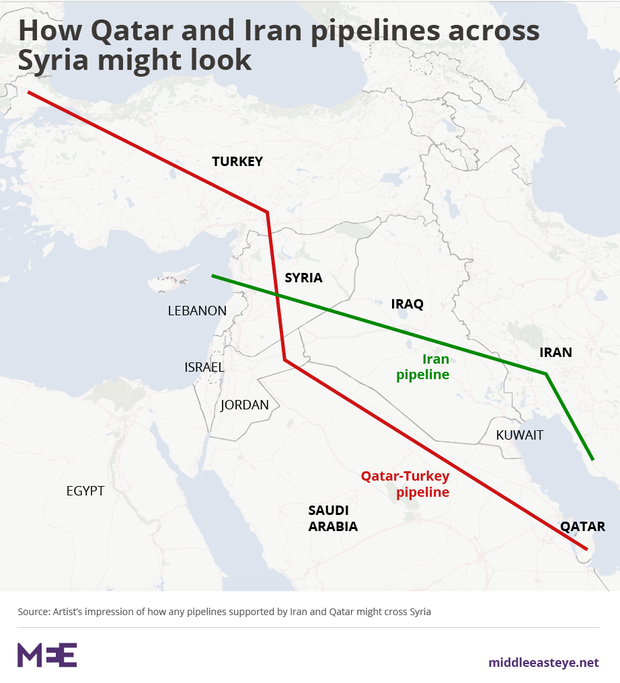

The bloodshed, so the theory goes, is a proxy battle about two proposed pipelines which would run across the country and on to Turkey and Europe.

While neither pipeline has left the drawing board, or indeed was ever realistic, this has not dampened the theory’s popularity as a core reason for the Syria conflict.

A Syrian man tries to refine crude oil in the Al Raqqa countryside in April 2013 (AFP)

The first pipeline is allegedly backed by the US and runs from Qatar through Saudi Arabia and Jordan to Syria. The second is a supposedly Russia-backed pipeline that goes from Iran, via Iraq, to Syria.

Syrian President Bashar al-Assad, it is claimed, rejected the Qatari pipeline in 2009, at the request of Moscow, to ensure that European reliance on Russian gas would not be undermined.

As a result, some commentators claim, the US and its European and Gulf allies, including Qatar, decided to orchestrate a rebellion against Assad to ensure that their pipe dreams became a reality rather than the Iranian option. Russia, in turn, backed Syria to ensure its own energy interests prevailed. Iran is also an ally of the current regime in Damascus.

These claims have been promoted in several quarters: the Qatari-based Al Jazeera first floated the concept of a « Pipelineistan war » in 2012.

Even US establishment journal Foreign Affairs and the Guardian newspaper picked up on the theory, which gained further traction in 2016 in an article by Robert Kennedy Jr, and was flagged by, among others, Jill Stein of the Green Party, a former US presidential candidate.

The idea was floated again after the US bombing of Syria in April. This, it was claimed, was further « proof » of Washington’s desire to oust Assad and enable Europe to diversify its gas dependency away from Russia.

While the US has been covertly working with Gulf allies against the Assad regime, controlling Syria’s energy resources and pipeline networks was not a primary concern. If so, it would be a very low priority for regime change.

Why? Firstly, the timeline is wrong. Covert action against Syria started under the George W Bush administration, in 2005, well before the alleged Qatari offer to Damascus in 2009.

« We can see US action against the Syrian regime well before the notion of this pipeline came into existence, » says Justin Dargin, an energy scholar at Oxford University.

Secondly, the pipeline hypotheses do not stand up to the realities of how energy is transported through the Middle East and the obstacles faced by pipeline proposals, many of which fail to come to fruition. Even the Arab Gas Pipeline, whose second phase came online in 2005, has been mired in problems.

Robin Yassin-Kassab, author of Burning Country: Syrians in Revolution and War, says the Pipelineistan theory also ignores how the conflict started and the early months of the revolution.

« Like all conspiracy theories, it thrives on the absence of content and in-depth knowledge of the country, » he says.

1. Domestic demand

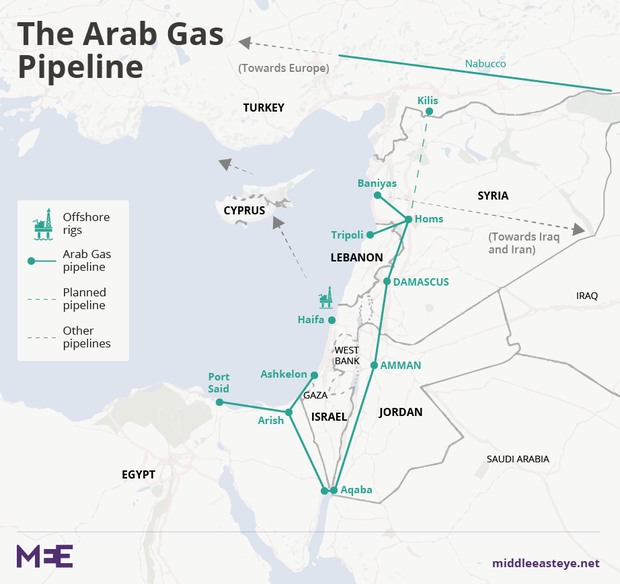

In 2009, Syria announced a policy that attracted minimal attention beyond its borders at the time. Called the « Four Seas Strategy, » it aimed to turn the country into a transit hub for gas between the Gulf, the Black Sea, the Caucus and the Mediterranean by expanding the 6,300 kilometres of gas and oil pipelines that criss-cross the country and by making use of the Euro-Arab Mashreq Gas Pipeline (AGP).

The AGP is not a core feature in the Pipelineistan narrative, but it does indicate the problems faced when it comes down to laying down pipelines in the region.

On the drawing board for nearly 20 years, construction of the AGP started in 2003. It was slated to cost $1.2 billion and run 1,200 km from Egypt to Jordan and Syria, before reaching Turkey. There, it would connect with the planned Nabucco pipeline, which would export gas to Europe.

The aftermath of a pipeline attack in northern Sinai in February 2011 (AFP)

One key element of the AGP plan was that Egypt would pump gas to Syria and Jordan. Syria would use the Egyptian gas and then top up the pipeline with gas from its own northern fields before it was sent north.

When war broke out in Syria in 2011, the last leg of the AGP – the stretch from Aleppo to Kilis in Turkey – was being constructed, never to be completed. But there were problems with the pipeline, which cost $1.5 million per kilometre, even before the conflict erupted.

Jim Deacons is a Scottish energy consultant who worked on the AGP in Syria, including designing the final phase of the project.

« When I left [Damascus in 2010] there wasn’t enough gas being fed up through Jordan, » he says. « The Egyptians were gas trapped. They didn’t have enough gas to export, despite signing contracts left, right and centre, so they couldn’t meet their obligations. »

Egypt’s gas production dropped from 220 million cubic feet (mcf) per day in 2010 to 80 mcf in 2011. The AGP was shut down in 2012 after terrorist attacks on the pipeline in Sinai and Egypt’s increasing need for gas for home consumption, and has not resumed operations.

Without enough gas, the AGP became a white elephant. « Effectively, that whole project was about exporting gas from Egypt to Europe, » says Deacons, « but in reality there was never going to be enough for it to be reasonably worthwhile. »

The same issues that plagued the AGP would also apply to any planned Iranian pipeline to Syria, namely a lack of gas.

« Iran has been attempting to develop its South Pars field [in the Persian Gulf] for a long time, » says Dargin, « but there are big obstacles, not least within Iran, where there are competing theories on which development plans should have priority. One idea is for gas to be used domestically as they’ve quite a lot of issues meeting their own needs. »

Indeed, Iran could not meet its own gas needs before an agreement was even signed with Damascus in 2011.

Deacons explains: « The whole point is that while Syria was actively talking about gas from Iran, Tehran was importing gas from Azerbaijan during the winter months.

« That really blows the theory of a gas grab out of the window. That Iran would supply gas to Syria was complete nonsense, and I told the Syrian [energy] minister that [at the time]. »

2. The missing jigsaw piece

The AGP’s viability beyond Syria was also dependent on Nabucco, another pipeline proposal intended to diversify Europe’s gas imports.

That idea, floated by a consortium of European and Turkish energy companies in 2002, was slated to cost more than $10 billion. The project would pipe 31 billion cubic meters of natural gas a year some 3,000 km from Central Asia, via Turkey, to Baumgarten in Austria. But by 2009 Nabucco had still not started, and projected construction costs ballooned to more than $25 billion.

The Turkstream project was cancelled after Turkey hit a Russian Su-24 fighter jet, pictured above (AA)

Eight years later, Nabucco has still not progressed due to the extraordinary cost and the politics at play. Dargin says: « At energy conferences, Nabucco is still brought up. But it’s like, ‘Where’s Waldo?’ It is phenomenal. »

The Nabucco pipeline would be essential for both of the contending pipelines, which would need to piggyback off it if they want gas to reach Europe. But while Russia was opposed to Nabucco and the idea of a Qatari pipeline, it was not enough of a reason for conflict, says Dargin. « You have a motive, a victim, but not a murder weapon. There is no evidence. »

Furthermore, Russia had managed to axe Nabucco in 2007 by announcing its South Stream pipeline project, which was to cut out Turkey altogether by crossing the Black Sea to Bulgaria and onto Europe.

The project was cancelled in 2014 due to political issues with the European Union.

Then Moscow proposed the Turkstream project in 2014, which was again to cut across the Black Sea but then on to the European side of Turkey. It was cancelled after a Russian jet fighter was shot down by Turkey in November 2015.

While both projects are back on the cards, especially Turkstream, neither could transport Iranian or Qatari gas across Turkey.

3. No Qatari offer to Damascus

The pipeline narrative, from 2013 onwards, also makes much mention of Damascus rebuffing an alleged Qatari offer in 2009 to build a pipeline. This part of the story hinges around statements by unnamed diplomats in a 2013 Agence France-Presse article about a meeting between Russia’s President Vladimir Putin and Saudi Arabia’s Bandar bin Sultan.

Qatar’s then-Emir Sheikh Hamad bin Khalifa al-Thani (R) and First Lady Sheikha Mozah bint Nasser al-Misned (L) welcome Syrian President Bashar al-Assad and his wife Asma at Doha airport in January 2010 (AFP)

The report says: « In 2009, Assad refused to sign an agreement with Qatar for an overland pipeline running from the Gulf to Europe via Syria to protect the interests of its Russian ally, which is Europe’s top supplier of natural gas. »

But Dargin says: « There are no credible sources that show that Qatar even approached Syria in 2009 and was rebuffed in the process. I am not saying it definitely did not occur, rather there is no evidence supporting this claim. »

Syrian experts also support Dargin’s rebuttal, highlighting the burgeoning economic and political ties between Doha and Damascus.

Yassin-Kassab says: « The absurdity is that relations between the Assad regime and the Qataris were excellent until summer 2011. Assad and his wife and the Qatari royal couple were also being portrayed as personal friends. »

Although Assad may have repeatedly criticized Qatar since late 2011 onwards for supporting « terrorists, » he has never publicly stated that Qatari support for the rebels was over a future pipeline.

Jihad Yazigi, editor of economy website Syria Report, says: « An important aspect that we don’t talk about is the Syrian government never said the Qataris were fighting for a pipeline; that is telling in itself, that Assad never mentioned it. »

4. The Moscow-Tehran connection

Then there’s the other part of the Pipelineistan puzzle – the Iran-Syria pipeline, also known as the Islamic Pipeline.

Yazigi explains: « The Islamic pipeline has been talked about for years. There were pre-contract memorandums of understanding, but until July 2011, there was no formal signing [between Syria and Iran]. You can’t argue this is a serious reason to destroy the whole country. »

Iranian President Hassan Rouhani (R) and Russian counterpart Vladimir Putin at the Gas Exporting Countries Forum (GECF) in Tehran in November 2015 (AFP)

While the project was politically expedient, it ignored economic and energy realities. First, the project was estimated to cost $10 billion, but it was unclear who would foot the bill, particularly as Tehran was – and still is – under US and international sanctions, as is Syria, since 2011.

Second, Iran lacks the capabilities to export significant amounts of gas. Sanctions mean it cannot access the advanced US technology that would allow it to exploit gas from the South Pars field that borders Qatar.

That Russia would force Damascus to veto a Qatari pipeline in favour of an Iranian one also ignores another reality – that Moscow and Tehran are potential energy rivals.

« Competition for gas access in the region is not between Qatar and Iran, but Russia and Iran, » says Yazigi.

« The ones with the biggest share of the European market are the Russians, and they want to secure that. They are the ones to fear the Iranians. »

Despite talk of how pipeline wars would enable Europe to diversify away from Russian gas, Russian gas exports to Europe hit a record high in January 2017.

In December 2016, commodities trader Glencore and the Qatar Investment Authority, the country’s sovereign wealth fund, acquired a 19.5 percent stake in Rosneft, Russia’s state-owned oil company, for $11 billion.

Result: Qatar has achieved easier access to the European market than any pipeline through Syria ever could offer.

5. Politics makes plan a pipedream

The Iranian pipeline would have to cross Iraq. Aside from the problems of building infrastructure in a conflict zone, plans to pipe gas just a short distance from Iraq to Syria were not viable even in 2009.

Deacons says that the Iraqis were observers of the AGP project and that he also discussed bringing gas in from Iraq over the Euphrates with the EU ambassador to Iraq.

Ras Laffan Industrial City, pictured here in October 2007, is Qatar’s key site for LNG production (AFP/handout)

« But it all got bogged down in politics. And the Iraqi infrastructure was so badly maintained and destroyed that they would have had to rebuild, not just fix, it.

« Huge infrastructure investment was needed before even bringing in pipelines. »

Likewise, politics would also impact any Qatari plans.

Dargin explains: « Such a pipeline would have had to pass through Saudi territory, which perhaps would have been an even larger obstacle than Syria, as Riyadh has blocked and obstructed numerous proposals for regional pipelines. »

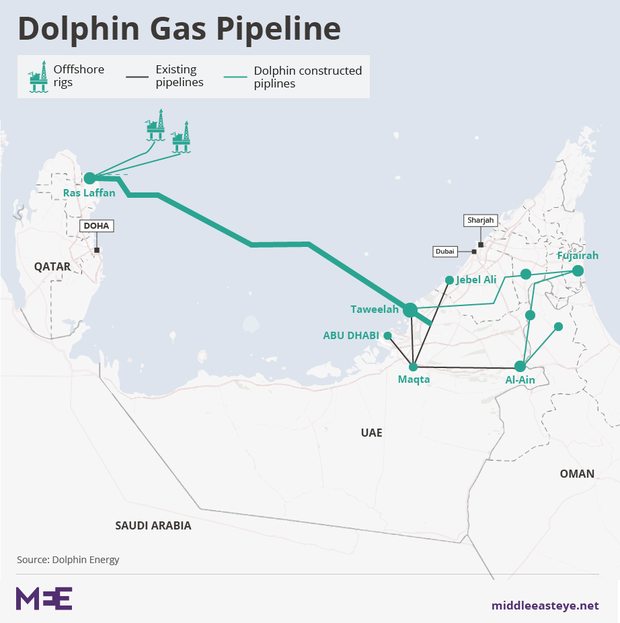

Indeed, Saudi obstruction caused planners in the mid-2000s to redraw routes for the Dolphin pipeline, which pipes gas from Qatar to the UAE. All three are members of the Gulf Cooperation Council.

« Saudi Arabia placed numerous hurdles in the undersea passage of the Dolphin pipeline as it would pass through its maritime boundaries, » says Dargin. « Saudi opposition was the principle reason we do not see a Qatari pipeline to Bahrain or Kuwait. »

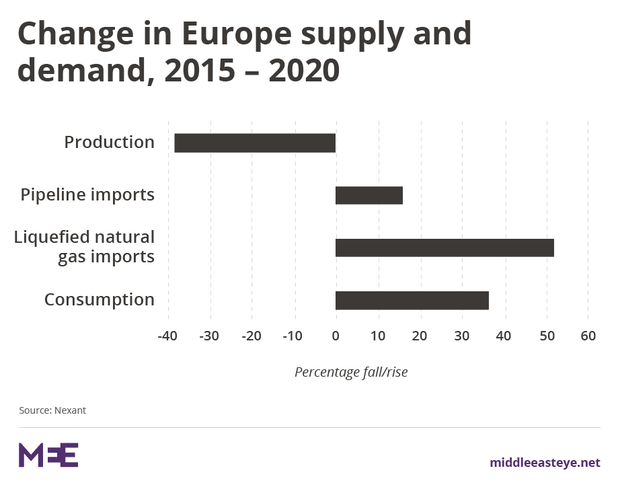

Indeed, Saudi opposition to Qatari gas pipelines has been so strong that Doha has switched its strategy from dry gas pipelines to liquefied natural gas (LNG) instead.

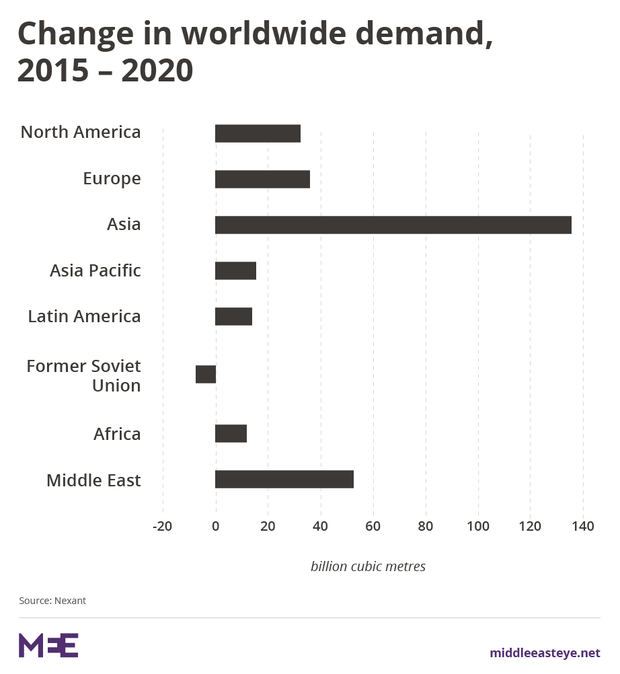

As a result, Doha has become the world’s largest LNG exporter during the past 15 years. It has invested more than $11bn on an LNG cargo shipping fleet that is independent of fixed pipeline infrastructure and can take LNG anywhere. The fastest-growing gas markets are in Asia, especially Japan, China, South Korea and India.

LNG is also a more competitive option than piping dry gas to Europe, where gas demand is flat and forecasts depressed compared to Asia and within the Middle East itself.

Naser Tamimi, an independent Qatari energy expert, says: « With the existing infrastructure, Qatar doesn’t have enough gas to sell to Europe through a pipeline, as most contracts currently are to Asia and long-term, while demand within Qatar is rising. »

« A pipeline has to be economically justifiable and secure demand from buyers in the long-term to recover pipeline costs. »

« Maintaining the pipeline and paying transit fees to host countries, in the most optimistic scenario, would cost between $7-$9 per British Thermal Unit (BTU) to reach Europe. LNG is cheaper, even with the most expensive scenario, at $5-$5.50 per BTU. »

Such factors all coalesce to make both the Qatari and Iranian suggestions nigh impossible.

As Tamimi explains: « If Syria and Iraq stabilise, and political relations with Saudi Arabia and Iraq improve … after all of that, then you could think of a pipeline.

« But at the end of the day it’s a pipe dream. »

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Middle East Eye.

Paul Cochrane is an independent journalist based in Beirut, where he has lived since 2002. He covers the Middle East and Central Asia for specialized publications, business magazines and newspapers. His work has been featured in over 70 publications, including Reuters, Money Laundering Bulletin, Accountancy Futures, Commercial Crime International, Petroleum Review and Jane’s. Educated in Britain and the US, he earned a Master’s degree in Middle Eastern Studies at the American University of Beirut.